Table Of Content

While homeowners can exclude up to $250,000 of the gain ($500,000 if you're married filing jointly), real estate investors don't generally qualify for the exclusion because properties aren't their primary residences. Of course, property taxes change periodically, and your bill could be higher or lower than in previous years. This can happen when your home is reassessed or when your local government updates the tax rate (either up or down). If you don’t pay your property taxes on time, you might encounter additional fees that local governments will add to your bill.

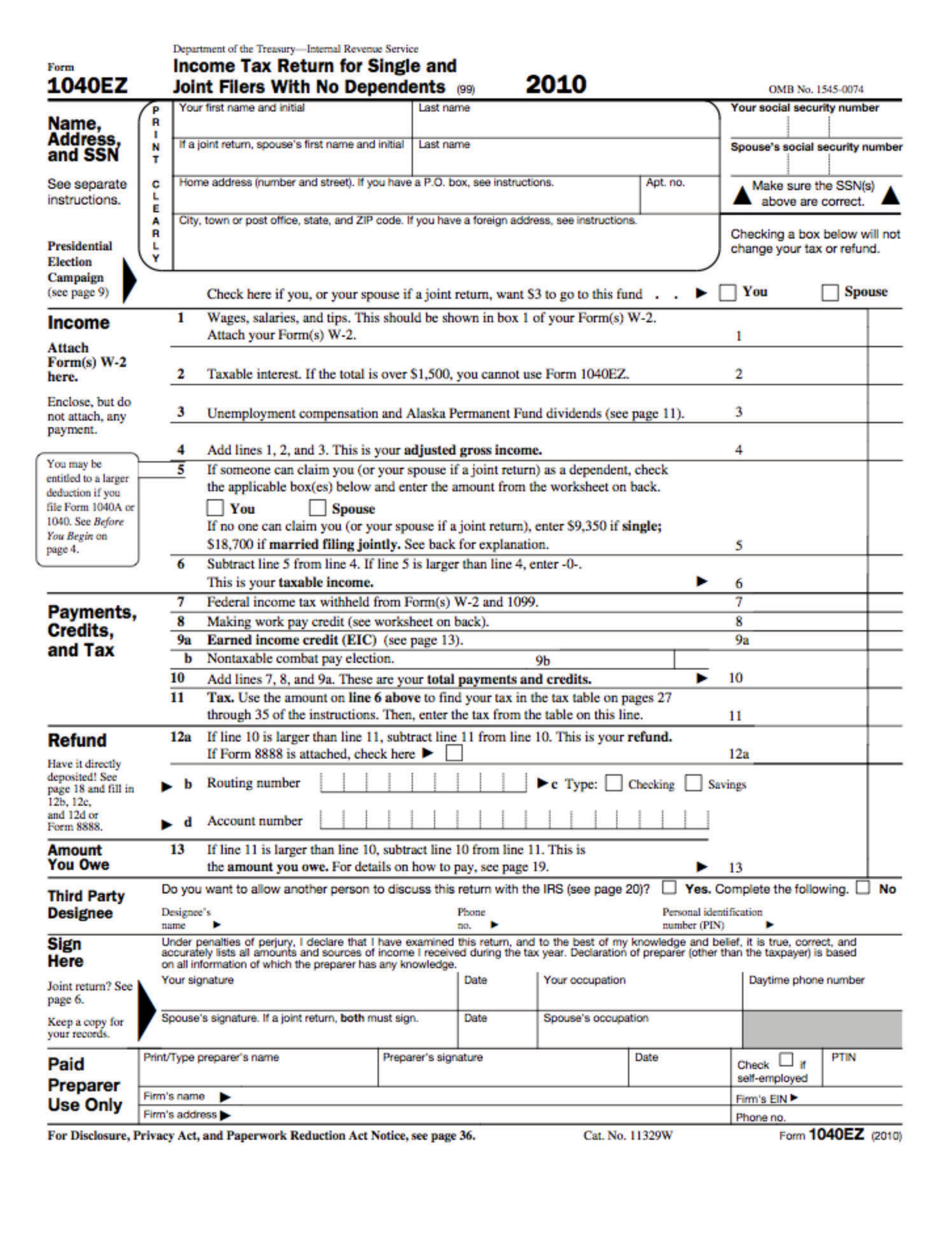

How to deduct property taxes on your tax return

If Andrew sells the house for $120,000, he will have a $20,000 gain because he must use the donor's adjusted basis ($100,000) at the time of the gift as his basis to figure the gain. If you contracted to have your home built on land that you own, your basis in the home is your basis in the land plus the amount you paid to have the home built. If you built all or part of your home yourself, your basis is the total amount it cost you to build it.

Publication 530 - Main Contents

Seniors and homeowners with disabilities received additional tax relief under the 2023 tax law. The average tax bill for a Travis County homeowner who is a senior or has a disability fell by 22% last year, about double the savings the average homestead taxpayer saw. One of the primary responsibilities of the Office of Ann Harris Bennett, Harris County Tax Assessor-Collector, is to collect and disburse property taxes. Property taxes also are known as ad valorem taxes because the taxes are levied on the value of the property.

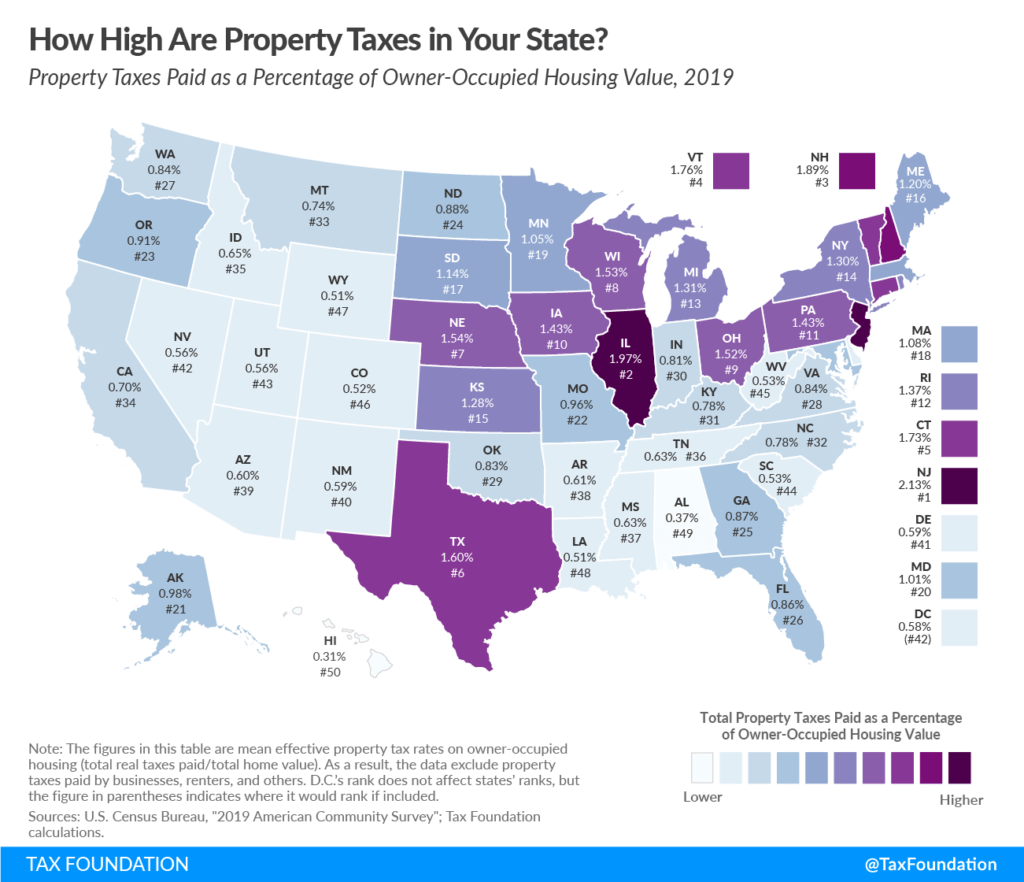

What Cities Have the Highest Property Taxes?

You must reduce your mortgage interest deduction by your share of any cash portion of a patronage dividend that the cooperative receives. The patronage dividend is a partial refund to the cooperative housing corporation of mortgage interest it paid in a prior year. If you pay off your home mortgage early, you may have to pay a penalty. You can deduct that penalty as home mortgage interest, provided the penalty isn't for a specific service performed or cost incurred in connection with your mortgage loan. If the total amount of all mortgages is more than the fair market value of the home, see Pub. 936 to figure your deduction if you have loans taken out after October 13, 1987, that exceed $750,000 ($375,000 or less if you are married filing separately).

Rather than taking one huge deduction when you acquire the property, you depreciate the costs across the "useful life" of the property. Typically, investment property is assessed at its "highest and best use." In general, that’s the most profitable use of the property. But it also must be legally permissible (e.g., no zoning or deed restrictions that would preclude that use of the property), physically possible, and financially feasible. Most areas offer a homestead exemption or a discount for living in the property full-time. You won’t qualify for this exemption if you use the home as a vacation or investment home.

If your old loan was a variable rate mortgage, you can use another method to determine the credit that you could have claimed. Under this method, you figure the credit using a payment schedule of a hypothetical self-amortizing mortgage with level payments projected to the final maturity date of the old mortgage. The interest rate of the hypothetical mortgage is the annual percentage rate (APR) of the new mortgage for purposes of the Federal Truth in Lending Act. The principal of the hypothetical mortgage is the remaining outstanding balance of the certified mortgage indebtedness shown on the old MCC. You can't deduct transfer taxes and similar taxes and charges on the sale of a personal home.

Gov. Phil Scott pushes for Senate help in property tax battle - WPTZ

Gov. Phil Scott pushes for Senate help in property tax battle.

Posted: Wed, 24 Apr 2024 22:14:00 GMT [source]

For a closer look, let's break down how much you could get with a homestead exemption. As we stated earlier, this exemption safeguards a surviving spouse and protects the value of a home from property taxes and creditors in the event a homeowner dies. Most states and counties include certain property tax exemptions beyond the full exemptions granted to religious or nonprofit groups. These specialized exemptions are usually a reduction of up to 50% of taxable value. You can see that Maricopa County takes a cut, as do local school districts and colleges, the library and the fire department.

Property Tax Calculators by County

If the property is in your name, you’re on the hook for the taxes. While nobody likes to pay real estate taxes, homeowners and investors can take advantage of numerous tax breaks that reduce the amount they owe. Veterans and active-duty service members who live in a home full-time might qualify for property tax exemptions. Check with your local and state government to see if you qualify for this type of exemption. However, because these property tax payments are estimated amounts, there are no guarantees that your mortgage will cover your full property tax bill.

Are property taxes deductible?

The average rate in the United States is substantially higher than in many European countries. Many empiricists and pundits have called for an increase in property tax rates in developed economies. They argue that the predictability and market-correcting character of the tax encourage stability. All 50 states and the District of Columbia have property taxes. Certain states have homestead exemptions or exemptions for older homeowners, people with disabilities, military veterans, and homeowners who install renewable energy systems like solar panels. After determining the market value of the property, the assessed value will be arrived at by taking its actual value and multiplying it by an assessment rate.

See Table 3 for a list of some of the items that can adjust your basis. John has a 60% ownership interest in the home, and George has a 40% ownership interest in the home. John paid $5,400 mortgage interest this year and George paid $3,600. This is the home where you ordinarily live most of the time. In addition, you can deduct any points paid by the seller. You can use Figure A as a quick guide to see whether your points are fully deductible in the year paid.

Note that some jurisdictions also tax business personal property (i.e., non-real estate property that the business owns). This includes equipment, fixtures, furniture, and other items that help you make money. You pay these taxes directly to your local tax assessor each year or as part of your monthly mortgage payment. Property taxes are based on the assessed value of your land and any buildings on it. Still, it’s helpful to have at least a basic understanding of what you’re getting into tax-wise when you own or invest in property. Here’s an introduction to real estate taxes to help you get started.

If you received HAF funds from an Indian Tribal Government or an Alaska Native Corporation and want more details about the HAF program, see frequently asked questions (FAQs) at IRS.gov/ITGANCFAQs. Your area’s property tax levy can be found on your local tax assessor or municipality website, and it’s typically represented as a percentage—like 4%. To estimate your real estate taxes, you merely multiply your home’s assessed value by the levy.

No comments:

Post a Comment